The demand for digital payment capabilities in Singapore has given rise to Fintech innovation. A few top Singapore FinTech firms are moving towards smart financial services by pushing the demand for virtual banking experience, encouraging digital payments, and helping with Buy Now, Pay Later Agreements. The right mix of talent, technical expertise, support on the capital provision, encouraging customers to buy FinTech products, etc., are falling under the evolution of Singaporean FinTech scenario.

CubePay is one of the leading Fintech firms in Singapore, adding to Singapore’s fintech ecosystem since 2014. This digital payment firm uses financial technology to encourage digital transformation to stay ahead of the competitive curve and leverage the technology for the betterment of the users.

CubePay is growing the digital ecosystem of the country. However, the company’s only challenge is implementing the cybersecurity risk mitigation strategy that includes international standards. They want to protect the digital payment scenario in Singapore.

The company has adopted ISO/IEC 27001 ISMS and ISO/IEC 27701 PIMS certifications to enhance the cybersecurity strategy and scenario in the country. These certifications from TUV SUD will help CubePay be transparent, agile, vigilant, and resilient towards cyber threats and data infringements. It will help build users’ trust too.

The success of CubePay in Singapore is evidence of the country's burgeoning FinTech revolution. As a reflection of Singapore's commitment to being a premier worldwide hub for FinTech innovation, it demonstrates the rising use of cutting-edge financial technologies and the strong support for digital payment solutions.

Source: Tuvsud

The Growth of the FinTech Sector in Singapore and Its Future

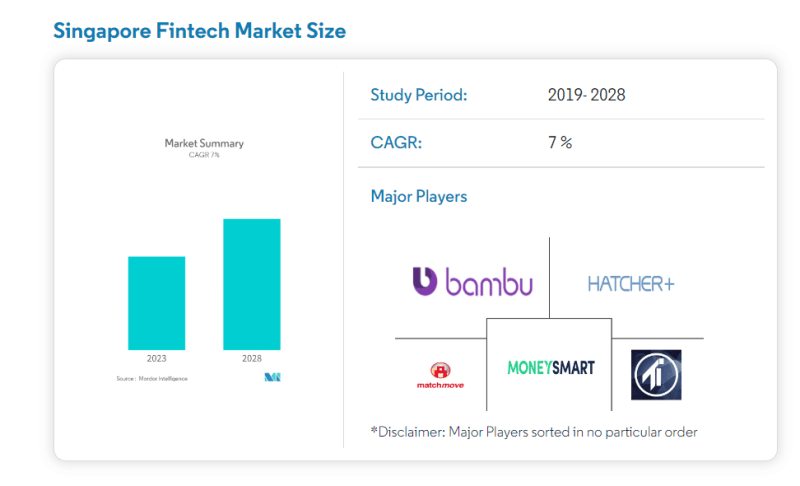

According to Mordor Intelligence, Singapore’s FinTech companies will rise at a CAGR of 7% between the years 2019 and 2028. The Singapore market was already valued at $7.8 billion. The FinTech sector performed well even during the pandemic because of the provision of contactless payments.

Source: mordorintelligence

Another report from KPMG states the leading fintech firms are doubling their share in the global FinTech market. The global share has doubled to almost 6.4% in the second quarter of 6.4%. The deal size in the FinTech market has increased to 10%, with an average investment of $43.9 million.

The FinTech market in Singapore is already watching a jump from 2019, with 40 industries using unique methodologies to develop user-centric apps. These industries are taking support from FinTech app development services providers to help them leverage their work towards the different domains. It will help the financial services providers succeed and support the new economic system.

The International Trade Administration has provided deep insight into Singapore’s Fintech space. There are more than 1000 FinTech firms and more than 40 innovation centers. The major FinTech spaces consist of FinTech Infrastructure providers- 18%, digital payment- 31%, RegTech- 17%, Lending- 15%, Money Management-8%, and Others- 11%. The country’s FinTech market is quite competitive for domestic and international companies.

Read more: Investing in Singapore's New Economy: Opportunities and Risks

Insight into Fintech Innovation in Singapore

The use of technology in the financial services industry in Singapore is on the rise, as it has the most advanced payment systems in the world. The innovation effort in Singapore was led by PayNow, which 10 popular banks created. There are three non-banking financial institutions also involved. MAS Singapore regulates these.

They have a dedicated fintech office in the country. The focus of MAS is on the development of the Smart Financial Center in Singapore. More societies are moving towards the cashless payment system to uplift the country’s digital infrastructure. Even the giant tech unicorns are taking software product engineering services from reputed companies. It is helping them get included and be inspired by the dynamic economy to get more inclusive in society.

Apart from this, the FinTech companies in Singapore get strong financial support from the Singapore government. The government provides sufficient working capital to help FinTech firms to grow and fulfill their financial goals. The Singaporean government has rolled out policies supporting technical products and services to strengthen the financial ecosystem.

The government policies encourage collaboration and community support. Even the users are accepting the digitization of the whole scenario. The technology consulting solutions will help FinTech companies to grow and develop manifold.

Top Singapore FinTech Firms Providing Digitized Financial Services

Here is the list of top-notch Fintech firms that are uplifting the digital scenario of the country.

- Grab

- Nium

- Wise

- XanPool

- Pace

- Coda Payments

- Atome Financial

- Bolttech

- Singlife with AVIVA

These are a few powerful and modern FinTech firms revolutionizing the digital payment landscape in Singapore. Moreover, the capital investors are making a point to invest in the region’s next FinTech superstar. FinTech firms are becoming the next place for employment.

Transforming ideas into exceptional digital experiences. Explore our case studies now!

Hire the Best FinTech App Development Company!

FinTech companies are rising in demand because of the innovation they offer in the payment landscape. Many Singaporean FinTech firms are growing rapidly and offering the best services.

FinTech services companies can take the services from Tntra Engineering, the software engineering development company. We are a pioneer in developing FinTech apps that add value to your company’s digital transformation. Our team of dedicated FinTech app developers will leverage your profitability and structure your development process.

Contact the Tntra Engineering expert for end-to-end Fintech software development. Whether you are a startup or an enterprise company, we help you build next-generation Fintech apps at affordable cost.

Top comments (0)