Author: leomachadop | Affiliation: PUC - RS | Email: leomachadop@gmail.com | Date: 28/08/2022

1. INTRODUCTION

We live in a contemporary era where changes occur in ways never before seen in human history. Innovations in various sectors of production and economy have undergone significant transformations, such as: how we consume music through streaming services, how we make payments via contactless transactions, how we connect with friends and family through social networks, among many other examples. These changes indicate that innovation will also occur in sectors with greater resistance to change, such as the financial market.

In this context, according to IANSITI and LAKHANI (2017), contracts, transactions, and their records are among the defining structures of economic systems with the aim of protecting assets and establishing organizational boundaries.

However, in an era where things tend to happen instantaneously, these tools create bureaucracies designed to manage them, often involving control by government or private institutions.

Blockchain promises to solve this problem with transparency, anonymity, and distribution, recording transactions between two parties in an efficient, verifiable, and permanent manner.

This paper aims to review the literature on blockchain and present the problems that this technology can help solve, thereby contributing to greater agility in the financial market.

2. THEORY

This section will be divided as follows, with the aim of presenting the relevant topics related to blockchain and the developments emerging from it:

- Cryptocurrencies

- Blockchain

- Bitcoin

- What is mining? Proof of work

- List of coins

- Exchange

- Ethereum

- Ethereum’s Merge

- Smart contracts

- NFT (Non-fungible Token)

- DeFi - Decentralized Finance

- Stablecoin

- CBDC (Central Bank Digital Currencies)

- Market potential

- Challenges for blockchain and the FTX case

- Brazilian players

2.1. Cryptocurrencies

As described by HOUBEN and SNYERS (2018), defining cryptocurrencies is not straightforward as it has become a “buzzword” referring to a wide range of technological developments related to cryptography, i.e., protecting information by transforming (encrypting) it into an unreadable format that can only be deciphered by those who possess the secret key.

2.2. Bitcoin

According to GHIMIRE and SELVARAJ (2018), Bitcoin was the first decentralized digital currency created by an individual under the pseudonym Satoshi Nakamoto, and was published in 2008 in the paper https://bitcoin.org/bitcoin.pdf. According to GHIMIRE and SELVARAJ (2018), Bitcoin has been growing across various business platforms as an alternative to fiat currencies (e.g., Brazilian real and US dollar), and some countries already recognize it as a payment method, where each user has an address that functions similarly to a traditional banking domicile.

2.3. Blockchain

According to Marco and Lakhani, blockchain is an open and distributed ledger that records transactions in a secure, permanent, and highly efficient manner. It was introduced in October 2008 as part of a proposal for Bitcoin, which is a virtual currency system that avoids a central authority from issuing currency and instead transfers ownership and confirms transactions through a process called mining. The first application of blockchain was Bitcoin.

The concept of a node, as described in ACADEMY (2021), is a physical or virtual connection point where all types of data and information can be created, sent, and received. In other words, they are the computers interconnected to the cryptocurrency network running the software that manages its entire operation.

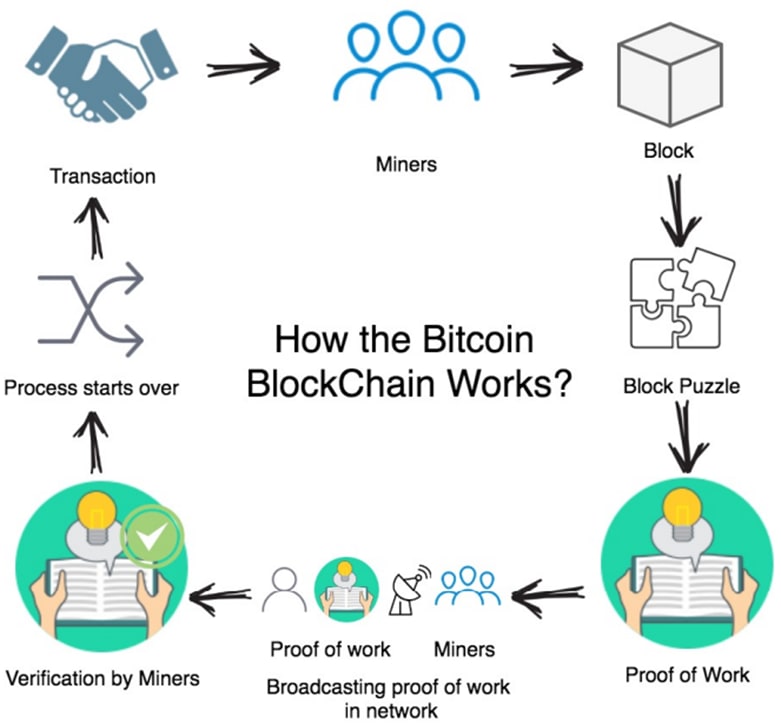

GHIMIRE and SELVARAJ (2018) present the functioning of blockchain as shown in the figure below:

Figure 1: How blockchain works

New transactions are added to all nodes with the following steps:

- Verify if transactions are valid

- Each node groups new transactions into blocks

- Each node works to discover the proof of work

- When a node finds the proof of work, it is broadcast to all nodes

- Nodes accept the block only if all transactions in it are valid

- Nodes accept the block and work on creating the next block

2.4. What is mining? Proof of work

The mining process involves solving the proof of work, which will be described superficially without delving into the specific details of how it is done.

As presented by GHIMIRE and SELVARAJ (2018), the proof of work involves solving a complex encrypted mathematical puzzle, which requires a high level of computational cost for verification, and the computational power depends exclusively on miners.

2.5. Exchange

According to Lin (2019), exchanges are a tool for buying and selling an increasing percentage of cryptocurrencies and have the following benefits:

- No need to trust a centralized exchange to protect and manage private keys

- Potential for lower transaction fees The major exchanges can be viewed at https://coinmarketcap.com/pt-br/rankings/exchanges/

2.6. List of cryptocurrencies

The list of available cryptocurrencies can be accessed at: https://coinmarketcap.com/.

2.7. Ethereum

According to CHAUHAN (2018), Ethereum was proposed in 2013 and launched in 2015, and currently holds the second place in the cryptocurrency hierarchy. Ethereum is a public distributed blockchain, but the distinction is its potential compared to Bitcoin. While Bitcoin only offers cryptocurrency transfer, Ethereum allows for the execution of decentralized applications on the blockchain network known as smart contracts, using the programming language Solidity.

On the Ethereum network, when a node mines a block, it is rewarded with a cryptocurrency token called Ether, which in turn is used to deploy smart contracts and pay the fees associated with each transaction.

2.8. Ethereum’s Merge

MENDONCA (2022) presents the change made on September 15, 2022, to the Ethereum network, shifting from proof of work (PoW) to proof of stake (PoS). In proof of stake validation, the blockchain sends a block specifically to a validator. They have a period to check the transaction, sign it, and send it to other validators to agree with this validation, and everything is done automatically.

2.9. Smart contracts

A smart contract is a self-executing digital agreement that allows two or more parties to exchange money, property, shares, or anything of value, always in a transparent manner, avoiding conflicts and the need for third parties or regulatory authorities, such as central banks ZAPOTOCHNYI (2022).

A smart contract contains the same rules as a traditional contract, along with obligations, and verifies whether the conditions have been met. They are executed on a blockchain network, and when the interested parties agree to its terms, the program will execute automatically. Below are some examples of applications with smart contracts.

2.9.1. NFT (Non-fungible Token)

An exclusive digital identifier that cannot be copied, replaced, or subdivided, registered on a blockchain, and used to certify authenticity and ownership. According to Definition of NFT (2022), NFT ownership is recorded on the blockchain and can be transferred by the owner, allowing NFTs to be bought and sold. NFTs can be created by anyone and require little or no coding skills to create. According to EDUWAB (2022), the main uses of NFTs are: digital art, gaming, music, film. Smart contracts have enabled the creation of non-fungible tokens (NFTs) by allocating ownership and managing the transferability of NFTs.

2.9.2. Copyright management

Smart contracts can simplify and facilitate royalty payments DILMEGANI (2022).

2.9.3. Data markets

Platforms where users buy or sell different types of datasets and data streams from various sources, with companies like Datapace and Ocean Protocol using smart contracts to carry out operations DILMEGANI (2022).

2.9.4. Gaming

Smart contracts in games are used to allow players to perform common transactions, such as buying and selling items and specific game actions, such as waging wars for loot, character creation, etc.:

- Axie Infinity: has various smart contracts used for different activities in the game, such as selling land, claiming, and creating rewards PEPI (2022)

- RobotEra: allows players to create experiences within a Metaverse world. In the RobotEra Metaverse, players can interact with each other and play, fostering a strong community. Virtual lands, known as continents, and customizable robot companions take the form of NFTs, and players can customize the construction or personalize a continent/companion before selling it for profit PEPI (2022)

2.9.5. Healthcare

Patient records need to become automatically immutable and accessible only to specific researchers. Encrypgen

uses smart contracts to transfer patient DNA data to researchers for clinical trials DILMEGANI (2022).

2.9.6. Insurance

Smart contracts can improve insurance processes by automating claims management and data collection, for example:

- In 2017, AXA launched a Fizzy insurance product that used smart contract technology to handle insurance claims for flight delays, and payment was triggered automatically if a delay exceeded two hours; however, it was discontinued in 2019 DILMEGANI (2022)

- B3i provides insurance solutions on a blockchain platform, for example, providing smart contracts for reinsurers where contract terms can be parameterized DILMEGANI (2022)

- Arbol provides weather and climate coverage with Ethereum-based smart contracts for agriculture, energy, maritime, and hospitality sectors. Smart contracts receive weather data almost in real-time and pay the correct party when the specified event occurs DILMEGANI (2022)

2.9.7. Logistics

Supply chain management manages the flow of goods and involves actively streamlining the supply-side activities of a company. When it reaches its destination, the ownership status of the item changes. Using smart contracts with the help of IoT sensors, if an item is lost during the process, its location can be detected. Routine tasks and payments can also be automated so that organizations do not need to communicate via documents DILMEGANI (2022)

- Walmart was able to trace the source of products using smart contracts

- HomeDepot improved its supplier management process by reducing the time to resolve discrepancies with them

2.9.8. International trade finance

We.trade offers smart contracts, eliminating credit risk by ensuring that when one party fulfills their obligations as outlined in the smart contract, payment is made automatically DILMEGANI (2022).

2.9.9. Real Estate

Smart contracts can accelerate the property transfer process. Property transfer contracts can be programmed and executed automatically. Propy facilitated the world’s first real estate transaction using smart contracts in 2017 DILMEGANI (2022)

- Rental: properties can also be rented using smart contracts. Rent Peacefully allows for renting and listing properties on the blockchain

- Real estate investment: smart contracts can be written for real estate transactions to provide rental income or dividends to holders

2.10. DeFi - Decentralized Finance

According to JENSEN and VON WACHTER (2021), decentralized financial applications (DeFi) represent a new generation of consumer-focused financial applications built as smart contracts deployed on blockchain technologies without the need for intermediaries.

Smart contracts have enabled sophisticated transactions such as loans, borrowing, and derivatives trading on DeFi platforms. Examples include:

- AAVE: A DeFi platform that allows for lending and borrowing across various cryptocurrencies DILMEGANI (2022)

- Opyn: A DeFi derivatives trading platform that uses smart contracts for options trading DILMEGANI (2022)

2.11. Stablecoin

As mentioned by MERCADOBITCOIN (2022), stablecoins are digital assets designed to maintain a 1:1 parity with fiat currencies issued by governments and central banks, and can be backed by various assets: gold, euros, oil, or even the S&P 500 index. Types of stablecoins include:

- Fiat-backed: Pegged 1:1 with fiat money issued by central banks and governments

- Commodity-backed: Based on physical commodities such as gold or oil

- Crypto-backed: Backed by other cryptocurrencies

- Algorithmic or non-collateralized: Fully backed by algorithms and smart contracts

2.11.1. Major Stablecoins

- Tether: A digital currency created to mirror the value of the US dollar COINMARKETCAP (2022a)

- USD Coin: A stablecoin pegged to the US dollar at a 1:1 ratio. Each unit in circulation is backed by $1 held in reserve, a mix of cash and short-term US Treasury securities COINMARKETCAP (2022b)

- Binance USD: A stablecoin pegged 1:1 to the US dollar, issued by Binance COINMARKETCAP (2022c)

- DAI: An Ethereum-based stablecoin, with issuance and development managed by the Maker Protocol and the MakerDAO decentralized autonomous organization COINMARKETCAP (2022d)

2.12. CBDC (Central Bank Digital Currencies)

According to MIKHALEV (2021), central bank digital currencies (CBDCs) represent a new form of electronic money, unlike cryptocurrencies such as Bitcoin or Ethereum, which are issued by central banks of specific countries as a digital version of banknotes. Countries where CBDCs have been launched include:

- Bahamas: The Sand Dollar was issued by the Central Bank of the Bahamas in October 2020, becoming the world's first national CBDC SMITH (2022)

- Nigeria: Became the first African country to launch a CBDC, the eNaira, stored in a digital wallet and used for contactless payments in-store and money transfers SMITH (2022)

- Eastern Caribbean Currency Union: Created its own digital currency, DCash, aimed at speeding up transactions and reaching unbanked individuals SMITH (2022)

In Brazil, the Real Digital project is planned for launch in 2024.

2.13. Market Potential

According to a study by LTD (2022), the global blockchain market was valued at $4.67 billion in 2021, and it is projected to reach $163.83 billion by 2029, representing a compound annual growth rate of 56.3%.

2.14. Challenges for Blockchain and the FTX Case

MOVEMENT 2022 describes FTX as a cryptocurrency exchange with a market value of $32 billion that declared bankruptcy, being referred to as the "Lehman Brothers Moment" of cryptocurrencies (a reference to the 2008 financial crisis). Alameda Research, a hedge fund founded in late 2017, promised higher returns compared to traditional investments and used aggressive marketing to attract funds and clients.

On November 6, 2022, Binance announced it would sell approximately $530 million in FTT (FTX network token). However, FTX was unable to process the request, leading to a liquidity crisis due to insufficient funds and resulting in a withdrawal freeze. Binance attempted to acquire FTX but did not proceed due to concerns over irregularities, and FTX filed for bankruptcy on November 11, 2022. The aftermath of FTX's collapse continues to unfold, with many details still being investigated.

Following the FTX collapse and the ongoing uncertainties, various countries and governments are discussing and debating cryptocurrency regulation to prevent future collapses. KOLHATKAR 2022 states that investors are likely to become more cautious, and regulatory agencies overseeing digital assets are expected to be clearer and more stringent.

2.15. Brazilian Players

In Brazil, the following players provide access to some functionalities ESTADAO 2022:

- NuBank: Offers Bitcoin and Ethereum to clients and is developing Nucoin

- Mercado Pago: Launched Mercado Coin in August 2022, similar to a cashback program, where users earn part of their money back on MercadoLivre purchases, which can be used for future purchases or traded for other available cryptocurrencies

- 99pay: Allows Bitcoin purchases starting from R$1.00 and has also started offering Ethereum

3. CONCLUSION

As presented in this work, the primary motivation for creating blockchain was to aid in the de-bureaucratization of financial services, initially with Bitcoin and later with the help of the Ethereum community and smart contracts, which enable the creation, design, and maintenance of various business models.

It is important to highlight Ethereum's concern with environmental issues by shifting from proof of work to proof of stake and finally reaching a consensus after years of debate.

Exchanges have taken on a significant role in the cryptocurrency space, managing numerous wallets. However, using exchanges requires caution as they can access user wallets, which may lead to frauds such as the FTX case in late 2022.

Blockchain also plays a major role through CBDCs in assisting with the democratization of financial services globally. Financial inclusion tends to improve the conditions of people/countries/continents by providing greater opportunities for achieving necessary milestones. It is also interesting to note that some countries, through their central banks, are already implementing or testing concepts for these currencies, as seen with Brazil's Real Digital project.

The market potential for blockchain is substantial. The projected figures may be revised and updated, but based on the presented values, the market has significant potential. In Brazil, companies like MercadoPago, PicPay, and NuBank are already promoting blockchain technology, and this list is likely to grow in the coming years, although it depends on the macroeconomic scenario, global geopolitical stability, and pandemic control.

REFERENCES

ACADEMY, B. O que é um nó?, 2022. Disponível em: https://academy.bit2me.com/pt/que-es-un-nodo/.

CHAUHAN, A. et al. Blockchain and Scalability. 2018 IEEE International Conference on Software Quality, Reliability and Security Companion (QRS-C), jul. 2018.

COINMARKETCAP, Binance USD (BUSD) Preço, Gráfico, Capitalização de Mercado, 2022d. Disponível em: https://coinmarketcap.com/pt-br/currencies/binance-usd/.

COINMARKETCAP, Dai (DAI) Preço, Gráfico, Capitalização de Mercado, 2022b. Disponível em: https://coinmarketcap.com/pt-br/currencies/multi-collateral-dai/.

COINMARKETCAP, Principais Tokens Stablecoin por Capitalização de Mercado, 2022a. Disponível em: https://coinmarketcap.com/pt-br/view/stablecoin/.

COINMARKETCAP, USD Coin (USDC) Preço, Gráfico, Capitalização de Mercado, 2022c. Disponível em: https://coinmarketcap.com/pt-br/currencies/usd-coin/.

Definition of NFT, 2022. Disponível em: https://www.merriam-webster.com/dictionary/NFT.

DILMEGANI, C. Top 9 Smart Contract Use Cases & Examples, 2022. Disponível em: https://research.aimultiple.com/smart-contracts-examples/.

EDUWAB, How to Create an NFT – Simply Explained, 2022. Disponível em: https://eduwab.com/how-to-create-an-nft-simply-explained/.

ESTADAO, Brasileiros passam a acessar mercado cripto via fintechs; entenda - Criptomoedas. Disponível em: https://einvestidor.estadao.com.br/ultimas/fintechs-passam-a-negociar-criptomoedas/.

GHIMIRE, S.; SELVARAJ, H. A Survey on Bitcoin Cryptocurrency and its Mining, 2018. Disponível em: https://ieeexplore.ieee.org/document/8638208.

HOUBEN, R.; SNYERS, A. Cryptocurrencies and blockchain Legal context and implications for financial crime, money laundering and tax evasion STUDY Requested by the TAX3 committee, 2017. [s.l: s.n.]. Disponível em: https://www.europarl.europa.eu/cmsdata/150761/TAX3%20Study%20on%20cryptocurrencies%20and%20blockchain.pdf.

IANSITI, M.; LAKHANI, K. The Truth About Blockchain, 2017. Disponível em: https://hbr.org/2017/01/the-truth-about-blockchain.

JENSEN, J. R.; VON WACHTER, V.; ROSS, O. An Introduction to Decentralized Finance (DeFi). Complex Systems Informatics and Modeling Quarterly, n. 26, p. 46–54, 30 abr. 2021.

KOLHATKAR S. Will the FTX Collapse Lead to Better Cryptocurrency Regulation? Disponível em: https://www.newyorker.com/business/currency/will-the-ftx-collapse-lead-to-better-cryptocurrency-regulation.

LIN, L. DECONSTRUCTING DECENTRALIZED EXCHANGES, 2019. [s.l: s.n.]. Disponível em: https://assets.pubpub.org/ob89i66u/61573938834913.pdf.

LTD, R. Blockchain Technology Market Size, Share & Trends Analysis Report by Type (Private Cloud, Public Cloud), by Application (Digital Identity, Payments), by Enterprise Size, by Component, by End Use, and Segment Forecasts, 2022-2030, 2021. Disponível em: https://www.researchandmarkets.com/reports/4582039/blockchain-technology-market-size-share-and.

MENDONCA, C. “The merge” da Ethereum: entenda o que é isso e os efeitos na cripto, 2022. Disponível em: https://blog.nubank.com.br/the-merge-ethereum-o-que-acontece-com-ether/.

MERCADOBITCOIN, O que é Stablecoin e qual a sua função, vale a pena?, 2022. Disponível em: https://blog.mercadobitcoin.com.br/o-que-e-stablecoin-e-qual-a-sua-funcao.

MIKHALEV, I. et al. CBDC Tracker, 2021. [s.l: s.n.]. Disponível em: https://cbdctracker.org/cbdc-tracker-whitepaper.pdf.

MOVEMENT, Q. AI-POWERING A P. W. What Happened To Crypto Giant FTX? A Detailed Summary Of What We Actually Know So Far. Disponível em: https://www.forbes.com/sites/qai/2022/12/13/what-happened-to-crypto-giant-ftx-a-detailed-summary-of-what-we-actually-know-here/?sh=2b6e4ca760fa.

PEPI, K. 10 Best NFT Games in 2022, 2022. Disponível em: https://cryptonews.com/news/best-nft-games.htm.

SMITH, I. CBDCs: These countries are using or launching digital currencies, 2022. Disponível em: https://www.euronews.com/next/2022/03/09/cbdcs-these-are-the-countries-are-using-launching-or-piloting-their-own-digital-currencies.

ZAPOTOCHNYI, A. What are Smart Contracts?, 2022. Disponível em: https://blockgeeks.com/guides/smart-contracts/#post-5615-_a8cy6rz9aai8.

Top comments (0)