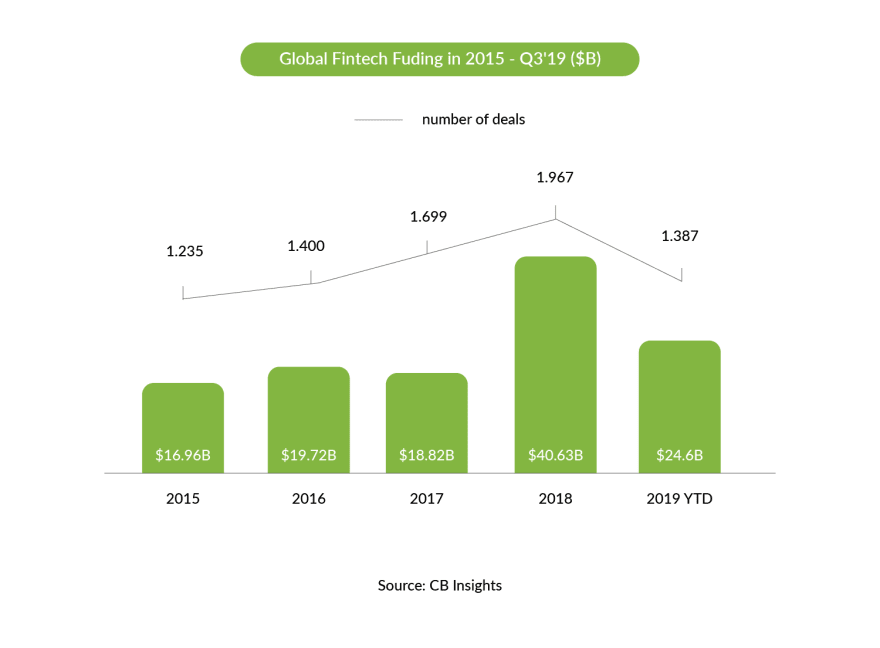

Once referred to as an emerging industry, fintech has become an undeniable breakthrough category in business and financial services. Despite being a relatively young industry in terms of time, modern fintech is an independent field with its own trends and regulations. The industry has collected enough capital to peak vertically and start expanding horizontally. The velocity of the sphere’s development is only multiplying: fintech funding in the third quarter of 2019 topped the total of 2017 funding, and six more unicorns emerged in 2019. The fintech startups launched as local businesses, and now they dominate the market, as they managed to become industry pioneers.

The businesses that launched as fintech startups are stepping out their comfort zones due to their solid market positions. As a result, they’re seizing opportunities to reach out to new demographics, introduce and test new products, and inhabit new locations. They’re now an integral part of the financial services value chain.

The industry is following the worldwide trend toward the digitization of services which is influencing virtually every aspect of human life, including everyday financial operations. For example, the introduction of financial technology created alternative credit and rent-to-own formats for deals. Therefore, the inescapable observation of the industry today is that it is growing from its origins as a novelty sector into a mature financial field with stellar capacity. Furthermore, trends in this industry are global, and key players will need to be vigilant in order to keep up with the industry and remain potent in it. In this article, we analyze the fintech market and discuss the most important trends that will affect it in the coming year. We’ll also explain how to leverage these trends to keep profiting from this industry.

Table of Contents

- Fintech Market Trends in 2020

- Things Fintech Companies Should Consider in 2020 to Survive

- Conclusion

Fintech Market Trends in 2020

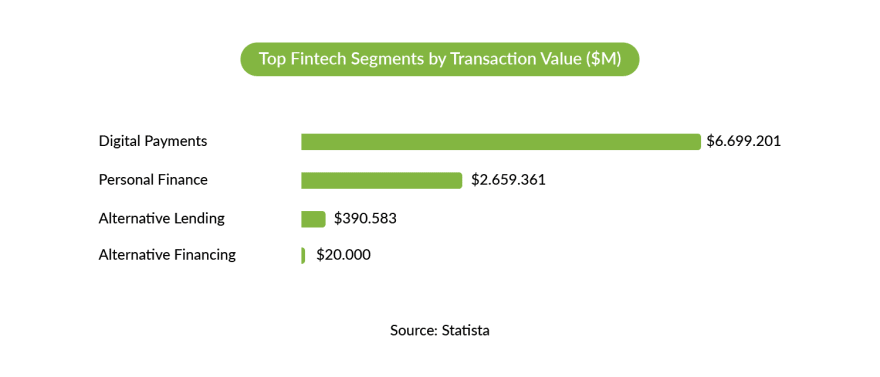

Today, fintech covers a lot of territory, including personal finance, insurance, billing, capital markets, wealth management, real estate, regtech, and cryptocurrency. All of these have their own individual specifications and emerging trends. However, if you connect them to fintech as a whole, the trends ultimately involve the industry’s most dynamic branches and depend on the economic and political processes arising from fintech’s globalization. Thus, in terms of geography, the industry is tending to target unoccupied locations in Asia and Africa. Meanwhile, British companies formerly within the European Union are maintaining their leading positions in the world. However, because of Brexit, they now face turbulence and uncertainty, which, in turn, is affecting related companies worldwide. The resources for new markets and customers in fintech in the UK are now declining and the future of these businesses is in jeopardy.

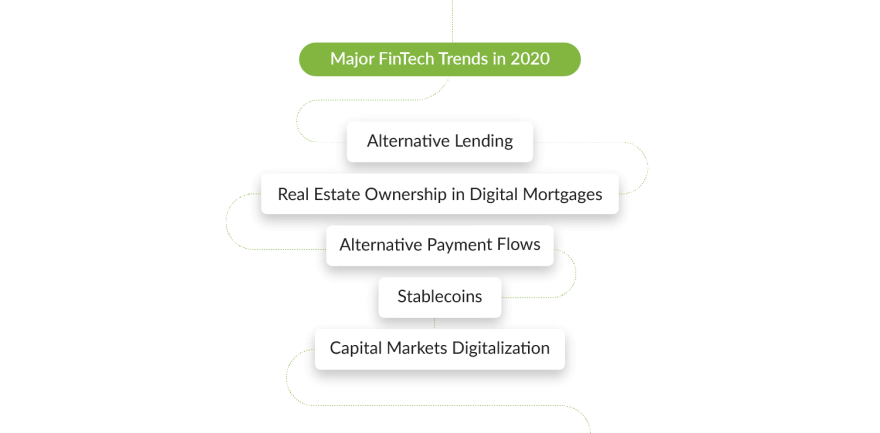

Based on fintech development in the above sectors and the global market situation, we’ve identified five major fintech trends for 2020:

- Alternative lending

- Real estate ownership in digital mortgages

- Alternative payment flows

- Stablecoins

- Capital markets digitalization

Alternative lending

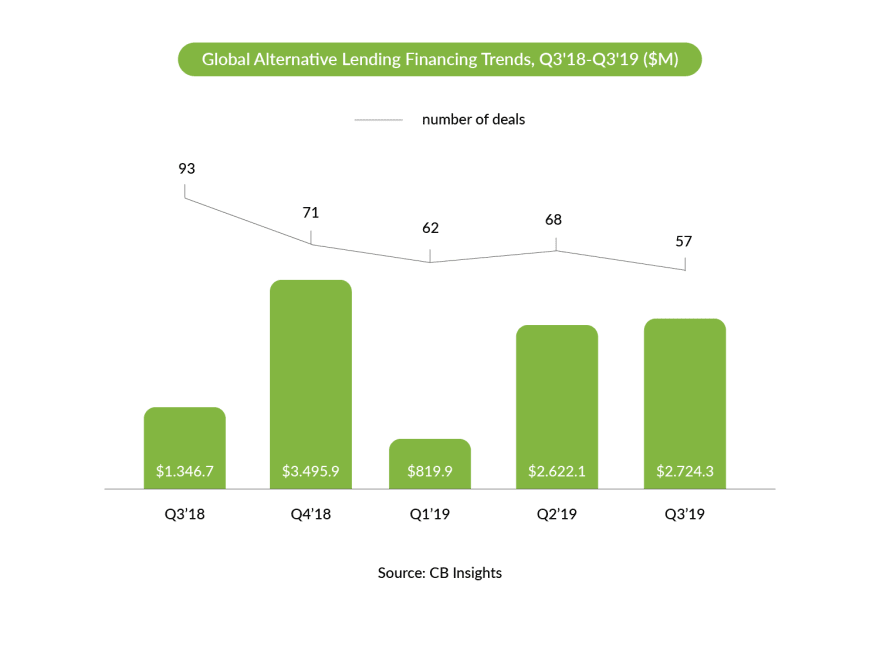

Alternative lending works via online platforms through which traditional institutional borrowers seek investors looking for attractive investments. It started as peer-to-peer borrowing, and currently, most of the investors are institutional. However, the number of such deals worldwide reduced last year, largely because of regulatory intensification in Asia. Compared to the third quarter of 2018, the third quarter of 2019 saw a reduction in the number of deals and the amount of money extended via loans, according to Global Fintech Report by CB Insights.

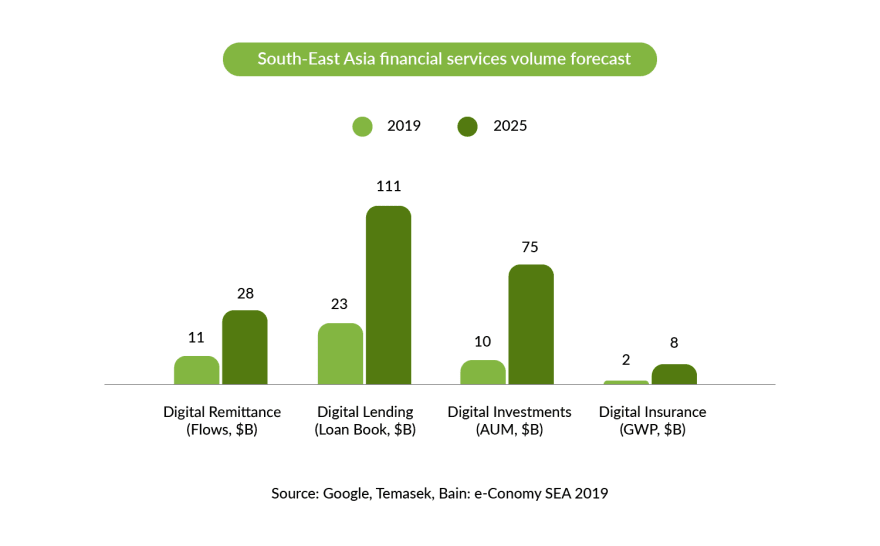

At the same time, there is South-East Asia, which has an emerging collaborative ecosystem between countries which will profit from alternative lending. The position of the region in the global fintech industry will solidify when countries create flow through such frameworks as the pan-Asian Fintech Cooperation Committee and the Asia-Pacific Fintech Network. Lending will retain its peer-to-peer nature, but will be regulated and used by larger players. Therefore, the popularity of alternative lending will only increase in 2020.

Finally, in the US, the alternative lending system has developed to the point where it can target not only SME stakeholders, but also students. This can help many people solve their student loan problems, which are severe for people who have no choice but to fund their education, and, as a result, overpay for it. Due to their unaffordability and the lack of other options, student loans become burdens for those taking them out and a problem for the government, as student-loan debt is increasing. In this context, an alternative lending model and income-sharing agreements (ISA) offer a long-awaited solution.

Product example: Edly

Edly is an ISA marketplace for schools, investors, and students. It helps schools enable their students to get an education and helps investors find schools interested in funding. The fintech aligns the interests of all the participants: schools, students, and investors. Instead of returning the debt, the student connects their future post-educational financial profits to the pools of ISAs. Thus, there is no such drastic imbalance between the loan and the debt, as is the case with student loans.

New paths to real estate ownership through digital mortgages

There are two major tendencies in real estate fintech for 2020: the rent-to-own model, and cash guarantees. Both models facilitate real estate property purchases and create more comfortable purchasing conditions for buyers.

1) Rent-to-own

This model allows people looking for real estate deals to eventually buy a house without paying a mortgage. The rent-to-own agreement has two parts: the lease agreement and the option to purchase the property. The person that signs the agreement can buy the house within the period of the agreement. Here, buying the property remains an option, rather than an obligation of the party. Some agreements allow the lease payments to count towards the final purchase price.

Product example: Divvy

Divvy is an example of a successful implementation of the rent-to-own model. It works the following way: the client looks up available houses for sale and selects one they would like to rent and/or purchase. Then, Divvy buys the selected house and the client signs a rent-to-own agreement. White renting the house, the client builds equity with each payment.

2) Cash-guarantee

Essentially, in this model the company acts as a sponsor to the client who wants credit to buy a house or other real estate property. It’s a solution for people who are confident in their capacity to repay the debt but have certain issues with their credit record.

Product example: Flyhomes

Flyhomes is a company that provides the cash to guarantee the deal for the client. The cash in this situation acts as a guarantor, which the person must have if they want to take out a loan for the house. If they don’t have anybody, they can use this service and close their deal.

Alternative payment flows

This trend is dictated by the announcement of the US Federal Reserve about their plan to establish a real-time payment service that will simplify the process and work 24/7. The necessity for such a reform was also determined by technological advances and the speed at which people can recieve diverse services. At the same time, banking and payment systems remain quite conservative and slow compared to what technology allows today. Therefore, the US Federal Reserve plans to introduce its real-time payment system by 2024.

The attempt to launch such a system was introduced in 2017, but was not supported by all the banks in the US. The announcement created a conflict of interest between smaller and larger banks. The former saw it as an opportunity to access real-time payments without having to pay significant fees to their larger competitors. The latter, in turn, saw it as a threat to their existing private infrastructure, which they would potentially have to share with the Fed. The future payment system aims to unify all the banks and hold them to the same standard of rapid, round-the-clock payments.

For fintech companies, this is a good reason to focus on alternative payment infrastructure and the bright opportunities in alternative payment flows.

Product example: Rapyd

Rapyd is a UK-based business that offers a range of financial services, including rapid payments. It also deals with fund collection, checkouts, foreign exchange, and much more. Targeted at e-commerce merchants, marketplaces and banks, the product is based on a single API and offers most of the services its users might need.

Stablecoins: the new breed of cryptocurrency

In recent years, cryptocurrency has made a real splash due to the opportunities it opened up – not to mention the privacy, transparency, and security it offered. However, the major cons of cryptocurrency are instability in terms of rates, and unclear regulatory treatment. The cons proved to outweigh the pros for the traditional banking system, which is why financial institutions do not accept cryptocurrencies. For that reason, there is an emerging cryptocurrency that promises to combine the pros of blockchain and the traditional banking system: it’s designed to be as stable as the dollar or gold, and as transparent and secure as cryptocurrency. It is, logically, named Stablecoin.

Product example: Wells Fargo

Wells Fargo is a traditional banking and insurance company. In 2019, it created a pilot for its own stablecoin, Wells Fargo Digital Cash, which is backed by the US dollar. The company plans to run it on their own blockchain platform and only within the bank itself. If the pilot proves successful, the bank will use it for external operations.

However, certain factors are slowing the development of this potentially ideal currency format. The main factor is its reliance on the stability of traditional currency, which is tied to traditional financial institutions. For the stablecoin to be backed by traditional currency, it must establish traditional banking relationships with conventional banking systems. Here, the complication is that few banks are willing to take on this role due to compliance and credit risks. If stablecoin is backed by traditional currency, and then hacked, the bank backing it will incur an immense risk, which is why few banks are willing to jump on board with this idea or support its development.

Besides, there is the G-7 report that introduced new regulations to the cryptocurrency market and the operations within it. The problem is, before the report, blockchain had a lot more freedom, as it was not regulated, like a traditional financial institution. The cryptocurrency market had its own sandbox, which was disconnected from the global financial markets. The growing concern of the latter highlights the lack of regulation in the virtual currency world, which has weakened its position among traditional institutions.

Capital market digitalization

Capital digitalization itself is not the newest trend. It started a while ago and proved to have a niche in the market. Today, there are many online platforms for private and business investments, such as Clear Minds. However, the emerging trend is expansion – specifically, exchange houses going digital. Evidently, this process will take a lot of time, but there are reasons to believe that this trend is on the horizon.

Particularly, the shareholders of the London Stock Exchange supported the exchange’s $27 billion takeover by the data and analytics company Refinitiv. The deal was overwhelmingly supported by LSE shareholders and received upvotes from 99.27% of participants due to the “compelling opportunity” they saw in it. The chairman of London Stock Exchange views it as being in the long-term strategic interest of the company. Digitalization of the exchange will allow to raise revenue as well as distance it from politically sensitive areas, and embrace data and analytics as an inseparable component of the exchange market.

Thus, the deal has become a certain signpost of the tendencies concerning both the fintech and capital markets. For exchange houses and shareholders, it means that the principal factor in exchange will become the search for profits, as opposed to the political background of the investment and the players.

Things Fintech Companies Should Consider in 2020 to Survive

The trends we’ve reviewed each have a different development velocity and influence. However, they are shaking up the whole industry and its players, to some extent. To survive and profit in FinTech, a business has to navigate these changes and prioritize its goals. You don’t want to be overwhelmed with updates, but it’s crucial to know what companies need to pay closer attention to and follow the trends in this fast-growing industry. It’s best for a business to stay one step ahead of its competitors.

In that spirit, here are a few tips on what to keep in mind to thrive in FinTech in 2020.

1. Open architecture

You’ll want to prepare your product for integration with any API, which is why it makes sense to focus on creating interoperability. Regarding the trends we mentioned, products will gain new users, which is why companies should make sure products work equally well on different platforms. So, the goal is to balance cyber security, control, and accessibility, as well as to manage your product in the cloud. If your product is integratable with any API, it will be easier to adjust it to the needs of the market and emerging trends, as it will be possible to add new functions to the code you already have. Re-developing the product from scratch, in comparison, will require a lot more effort, resources, and valuable time, so you risk missing out, which is off-limits in the world of digitalization.

To make your product flexible and ready for integration, it’s best to use Python. In it, you’ll be able to modify your product’s parameters or features without making major or irreversible changes to it. Making sure you have great professionals on your team is another smart move you should make in fintech 2020.

2. Access to skilled employees

It may be an obvious idea that a company needs outstanding and motivated employees to grow. However, today’s industry is quite mature, which means there’s more competition among employers. It means that a decent expert can choose from a variety of options in the labor market, and their workplace criteria now go far beyond compensation and subject matter. For that reason, companies have to invent new recruitment methods that are not limited to the financial industry.

Also, companies need to create educational and growth opportunities for their talent based on the future competency requirements and the expertise of the employee. With practical training incorporated in the company’s culture, it will be easier to navigate trends and adjust to new developments.

Another challenge that today’s employers face is the inability to find talent locally. Naturally, in this case, the search must expand worldwide, and recruiters must be aware of the migration policies for the talent they’re looking for. As an example, the UK is a current leader in fintech, but the Brexit situation might result in a shortage of human resources, despite sufficient funding in the industry. According to International Financial Law Review, “Brexit has resulted in a lack of resources for new markets and customers for fintechs”, which, for companies, translates into an emerging need to find new ways to recruit the best employees.

3. Reduce costs by improving legacy systems and adopting AI

A number of human activities can be assigned to AI instead of people. The introduction of of robotics and automation will reduce the cost of human resources and optimize processes. Today, advanced robotics can perform not only jobs that require low skills and training. In fact, artificial intelligence can enhance the performance of, if not substitute for, higher-ranking positions.

The question of whether robotics will enter and change the approach to the intellectual workforce is not on the table anymore. Now, it’s only a matter of time. Thus, it’s in every company’s best interest to seek out opportunities to automate – today. Explore them, and figure out what potential benefits they will bring, deploy iterations, and adjust them to your particular business needs.

However, the launch of robotics will not mean a lack of workplaces. Conversely, you will soon need specialists that work with artificial intelligence, and they may be hard to find. This will both challenge companies to train AI specialists and allow them to save on wages in the future. In any case, artificial intelligence promises to become a vast part of fintech, which is why the best option is adopting it as soon as possible.

Conclusion

Today, the main focus in FinTech is exploring and claiming niches that are underdigitalized or not yet occupied. Companies can invent new ways to reach users whose needs or problems cannot be fixed, and are sometimes even caused by conventional banking. For example, look to the solutions that allow people to get student loans or buy a house without overpaying. These are revolutionary. Another aspect of banking digitalization is its potential increase in scale due to the participation of exchange houses and the introduction of a unified instant payment system. It signifies that conventional financial institutions are now collaborating with digital ones to make services faster and more user-oriented. The growing number of examples of successful collaboration between fintech and conservative financial systems only proves that the position of fintech will only strengthen.

Finally, to survive the dynamics of the industry, fintech players should focus on the flexibility of their product architecture and be ready to adjust it to accommodate market and technological changes. To do so, these companies must have the brightest talent and provide these people with educational opportunities, including those in robotic technologies and automation. This year will also show which trends will solidify in fintech and which ones may lose their relevance, so it’s important to keep on keeping up with these trends.

This article about 5 Trends that Will Disrupt the Fintech Market in 2020 was originally posted on Django Stars blog. Written by Artur Bachynskyi - COO at Django Stars

Top comments (0)